Paper

Lessons from our impact investing experience

The spread of impact investing among foundations is a wonderful example of our field’s collaborative nature at its best. Now we’re ready to pay it forward by sharing our approach and what we’ve learned along the way.

DATE

February 17, 2025

Contributor: Chris Romano, chief operating officer

While the Bush Foundation has made grants since 1953, impact investing is newer for us. Like grant-making, impact investing is about using capital to drive positive change. The distinction is that impact investments are designed for some or all of the money committed to be returned. We had much to learn as we set out to incorporate impact investing into our toolkit.

One of the advantages of working in a collaborative field like philanthropy is the opportunity to benefit from the wisdom and experience of our peers. As we explored impact investing, we learned a lot from other foundations including the McKnight Foundation, Rockefeller Foundation, MacArthur Foundation and F. B. Heron Foundation. Their generosity in sharing lessons and guidance has helped us and many other foundations get started.

The spread of impact investing among foundations is a wonderful example of our field’s collaborative nature at its best. Now we’re ready to pay it forward by sharing our approach and what we’ve learned along the way.

Our approach

Since 2017, we have made 36 impact investments in support of important problem-solving within our region, including addressing affordable home ownership, Native energy sovereignty and small business growth. Additionally, we have made nine other impact investments outside of our region.

We have taken an integrated capital approach, with a whole-organization, cross-functional strategy. Our approach has five notable components:

1. We have an integrated strategy across our endowment and programmatic investments.

Our impact investing strategy bridges our endowment and programmatic investments. We think of our work as two portfolios—an endowment portfolio and a program portfolio—with both overseen by the board. At the staff level, our chief operating officer has responsibility for ensuring both portfolios are aligned and making progress toward our overall impact investing objectives.

The endowment portfolio includes Mission-Related Investments (MRIs), which advance our impact objectives while aiming for market-rate returns, and Adjusted-Risk Investments (ARIs), which also advance our objectives and aim for market-rate returns but have more flexibility around risk tolerance. At the staff level, this portfolio is overseen by our managing director of investments. The investment committee provides governance oversight and approves new investments.

Our program portfolio consists of our Program-Related Investments (PRIs), which are investments that advance programmatic goals at a below-market rate of return, as well as any financial guarantees we commit. At the staff level, this portfolio is overseen by our community innovation director. The full board approves any new investment over $1 million, consistent with our overall community innovation program approach. The finance committee monitors investments in the portfolio with an annual review and discussion of any issues and modification of terms needed.

We also regularly make grants that complement our PRIs. We don’t track these in the program portfolio because we’re not expecting those grants to be repaid, but they’re a very important part of the strategy. Since 2022, 75% of our PRIs have been made in tandem with some grant funding for the recipient organization.

2. We have three impact objectives.

Our investments are guided by three impact objectives that align with our overall organizational purpose of inspiring and supporting creative problem solving—within and across sectors—to make the region better for everyone:

EQUITY: Ensuring individuals from all backgrounds have access to capital, addressing historical and current disparities in who gets funding to create and grow businesses.

- Why: We believe people of all backgrounds have great ideas and the talent to make those ideas happen. Data show that investment dollars have not been distributed equitably to reflect this. Our actions as an investor can help ensure people of all backgrounds have access to capital to make their great ideas happen.

PLACE: Strengthening local economies by investing in business growth and community development in Minnesota, North Dakota, South Dakota and the 23 Native nations we serve.

- Why: We believe that supporting business growth and community development in our region is a way for us to use our resources in a way that grows our local economies. Impact investments can help build strong communities and complement our grant-making efforts to create jobs and build wealth in our region.

SUSTAINABILITY: Supporting innovations that mitigate environmental impact and encourage sustainable business practices, with a strong focus on addressing climate change.

- Why: We believe climate change is an issue of critical importance with enormous social and economic consequence to the region we serve and our world as a whole. Our actions as an investor can support innovation and encourage changes in business practices to accelerate the transition to a just and sustainable economy and help mitigate the negative effects of climate change.

3. We make both “impact investments” and “aligned investments.”

To advance each of our impact investing objectives, we make investments that we consider either “impact investments” or “aligned investments.” Here’s what we mean by those two terms:

Impact investments: These investments are defined very narrowly. To be categorized as an impact investment in our portfolio, the majority of funds invested need to go directly toward advancing one of our impact objectives. For example, 100% of our investment in Granite Partners is invested in our region, helping to keep Greater Minnesota businesses locally owned for the long term. This meets our definition of an impact investment for our place objective.

Aligned investments: These investments are defined by more flexibly. To be categorized as an aligned investment, the organization or fund has to be significantly committed to and working toward one of our impact objectives. We’re willing to think about this expansively so we can consider opportunities that advance our purpose in creative ways or offer indirect or more nascent benefit. For example, we invested in BASE10, which has shared its profits with historically Black colleges and universities (HBCUs). While it doesn’t meet our impact investment definition, it aligns with the larger intent of our impact objective on equity.

This dual approach allows us to focus on the spirit of our work without reducing it to a set of simple, quantitative measures. We’re able to consider investments that advance our objectives in a variety of ways and fit into our overall portfolio in different forms. It requires some debate about what fits and doesn’t, and forces us to wrestle with what we’re trying to achieve—and what investments are truly meaningful toward that end.

Our definitions for impact investments and aligned investments for each of our three objectives are included in the chart below.

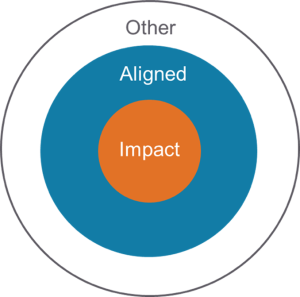

We visualize this approach using a bulls-eye framework, with impact investments at the center and aligned investments in the surrounding ring.

We track our progress with this visual approach, with a goal of having more and more of our assets represented in the impact and aligned parts of the bullseye. Our current goal is for 80% of our total portfolio to meet the criteria for impact or aligned investments on at least one of our objectives by 2027.

4. We take a developmental approach.

Our strategy is not just about the investments we select. We don’t think of fund managers as simply “in” or “out.” We talk about our impact objectives with all our managers and advocate for them in ways that align with the manager’s existing strategy. Rather than being driven solely by absolutes and quantitative measures, we want to understand the context in which our managers work and support earnest effort and progress.

For example, we might have a manager who is working to apply sustainability in their approach but has not yet reached a level of action that we would consider an impact or aligned investment. If we see sincere intent and meaningful progress, we’ll continue to support them.

Similarly, a manager might excel in advancing one of our impact objectives—such as sustainability—while contributing less to others, like equity. In such cases, we’ll share what we’ve seen and learned about the power of intentional work to overcome biases and the value of diverse perspectives in decision making. We believe that meaningful progress is achieved not just through outcomes but through partnership and shared learning.

5. We set and review goals annually with the board.

We conduct an annual strategic review with the full board to evaluate progress and set new goals. For example, in 2024, we celebrated achieving our 3-year goal of having $100 million in investments that meet our definitions for impact investments. At that same time, we set our current 3-year goal of having 80% of our total investments meet either impact or aligned criteria for at least one of our objectives by 2027.

We typically balance 3-year goals focused on portfolio composition with shorter-term, tactical objectives aimed at deepening our work or broadening our knowledge. For example, we have a current 1-year goal of sourcing more opportunities in North Dakota. Having a mix of 1-year and 3-year goals ensures a balance of ambition and adaptability and keeps us focused and accountable.

Lessons learned

As we’ve designed and refined our approach, we’ve picked up some key lessons that may be useful to others exploring impact investing:

Our impact investing strategy is owned by the full board of directors. The investment and finance committees have some delegated authority, but the full board sets goals, reviews progress and owns our overall success.

Initially, we tried having the investment committee develop and own our impact investing strategy. But we found that it was not well-suited for setting the big-picture strategic direction, especially given the tension between the committee’s traditional focus on maximizing returns and the emphasis on impact. Placing that responsibility at the board level ensures we have full governance and strategic alignment on all risks and tradeoffs.

In our program portfolio, our integrated and flexible approach helps us better meet the needs of organizations and find opportunities for impact.

In our program portfolio, we primarily invest in and through nonprofit organizations and community development financial institutions (CDFIs). We’re open to a range of ways to invest. To date, we’ve made PRIs in the form of loans, guarantees and equity investments, often with a complementary grant.

When we began our PRI work, we anticipated maintaining a ratio of roughly 4:1 between dollars provided as PRIs and those provided as grants. But we’ve found that greater flexibility allows for more impact. For example, providing a significant grant for loan loss reserves can enable an organization to attract additional capital from other funders, generating even more resources with which to pursue their mission. By focusing on the overall impact of the work we fund—and taking on whatever role is most effective in achieving it—our dollars can support the most possible good.

We talk with applicants to understand what form of support would be most useful to them. Often, an applicant might initially request a grant, but through discussion, we determine that a PRI would be more effective—or vice versa. (This flexibility is made possible by our integrated process for grants and PRIs—see the next lesson.)

Our single, integrated sourcing and approval process for PRIs and grants supports strategic decision making.

The Community Innovation (CI) grant program is our largest, most accessible front door for organizations looking for funding, whether they’re seeking a grant, a PRI or a combination. Having a single process for sourcing and deciding on both PRIs and grants allows us to make thoughtful, well-calibrated choices. We arrived at this after experimenting with several approaches, including proactive outreach by staff, open calls for proposals and collaborative sourcing with other funders.

This integration allows us to assess all programmatic investment opportunities using the same criteria for potential impact. It helps us calibrate our funding more strategically across both grants and PRIs, and mix and match them to maximize community impact.

The benefit of this approach is evident in our work with SAGE, the Standing Rock Sioux Tribe’s renewable energy power authority. We’ve supported SAGE in a number of ways, including a grant, a loan, equity credits and a funded guarantee to allow them to stay in the queue to be connected to the power grid. We were able to consider all these means of support through the same strategic lens and the same decision-making process, ensuring we were making the most of the different tools we have to offer. While most of our investments have not been as complex as this one, it’s a good example of trying to be as responsive as we can to a community need.

In our endowment portfolio, we’ve been able to achieve impact with market-rate investments.

As is true at many foundations, we had board members who were initially concerned about how an impact investing strategy might affect our ability to preserve and grow the assets we steward for community benefit. As a perpetual institution, we strive to make decisions with a long-term view of what will allow us to do the most good for the communities we serve.

While not every one of our impact investments has performed as we had hoped, we are pleased to report that early indicators are that, in many cases, we haven’t had to sacrifice returns. We’re confident that many of the impact and aligned investments within our endowment portfolio will perform as well as, or even better than, our other investments.

We’ve seen a growing number of established managers aligning their work with our impact objectives, alongside the emergence of new funds designed with these goals in mind. We’ve been able to find investment opportunities across asset classes that are often associated with impact investing—like venture capital and private equity—but also investments in public equity and hedge funds, which are less typical and require more effort to identify.

Adjusted-risk investments expand our possibilities for impact.

We find that adjusted-risk investments (ARIs) are one of the less-familiar concepts when we talk to others about our work. With ARIs, we’re still seeking market-rate returns, but we adjust our risk expectations to achieve them.

Like many organizations with large endowments, we’ve long operated with standard thresholds for the size of funds we invest in and the track records of their managers. This has been central to how we manage risk—favoring big, stable managers with long histories of strong performance. But this common practice makes it difficult for new firms to get money from investors like us and, therefore, creates a barrier to change in the industry.

By thinking differently about investment size and manager track record, we have far more options for investments that align with our objectives, including seeding and growing emerging funds. This adjusted-risk approach has been particularly valuable in helping to advance our objective around place.

Our increasing use of ARIs is one of a number of ways we’re trying to think differently about risk in our work. As a private foundation, we have more capacity for risk than most other kinds of institutions, which is something we can use strategically to have more impact.

At the Bush Foundation, we’re always working to do the most possible good with the resources we steward. We believe that impact investing helps us to do that. It reflects our broader commitment to aligning everything we do with our organizational purpose, as fully as possible.

We’ve benefitted greatly from the impact investing lessons shared with us by other foundations. Now, we’re glad to be able to share some of what we’re doing in the hope that it may be useful to others. As we continue to learn and develop, we welcome feedback and suggestions!

Contributors

Bush Foundation staff members who played significant roles in this work and developing this learning paper: Amy Anderson, Sophie Forest, Tony LookingElk, Carol Peterfeso and Jennifer Ford Reedy. And a shout out to contributing writer Mo Perry.

Continue reading

-

News

Opportunity to work with us

As part of our office move later this year, we are exploring possibilities for the build out of the ground floor of the building. We are in the early stages of this and considering different types of operating models and potential partnerships.

-

Staff note

Coordinating the work of our contact hub

We aim to be radically open in all that we do, and that includes being more accessible to more people and sharing what we learn along the way.

-

Staff note

Making every dollar work through impact investing

We have benefitted from the experience of other funders as we developed our impact investing approach. Now we are paying it forward and sharing what we have done and what we have learned.